Is Syria’s Instability Lebanon’s Opportunity? - Feb. 2012

- Tuesday, October 15, 2019

In business, there is nothing worse than making wrong assumptions. These translate into one of two things: bad investments or lost opportunities. In Lebanon, we keep hearing about how the Syrian crisis might negatively impact the security situation or even the economy in Lebanon. Barring a few incidents on the borders, and despite Syrian instability stretching over many months now, there has been no major security or economic incidents in Lebanon. Nor will there ever be. The point that most everyone is missing is that the Syrian situation is “socio-economic” and not “political”, “religious”, “sectarian” or otherwise and as such Lebanon is and will be safe for investors, both Syrians and Lebanese.

In business, there is nothing worse than making wrong assumptions. These translate into one of two things: bad investments or lost opportunities. In Lebanon, we keep hearing about how the Syrian crisis might negatively impact the security situation or even the economy in Lebanon. Barring a few incidents on the borders, and despite Syrian instability stretching over many months now, there has been no major security or economic incidents in Lebanon. Nor will there ever be. The point that most everyone is missing is that the Syrian situation is “socio-economic” and not “political”, “religious”, “sectarian” or otherwise and as such Lebanon is and will be safe for investors, both Syrians and Lebanese.

Let’s first remove the Lebanese fear factor by explaining how Syria’s troubles are purely a social struggle born out economic considerations for the upper and lower classes. We’ll begin with the good news for Lebanon. The country has stood strong in the face of a global financial crisis, domestic political uncertainty, and regional unrest, despite a slowdown in economic growth to 1-2 percent in 2011, following a yearly average of 8 percent during the 2007-10 period. GDP growth is expected to rebound to 4 percent in 2012.

The messy international economic situation which began in 2008 also had a moderate effect on Syria, but the current unrest, foreign trade sanctions, decrease of spending on basic items, together with foreign and local investors’ reluctance to invest, due to uncertainty, are all slowing growth. This went counter to Syria’s strong economic outlook at the start of 2011. The International Monetary Fund predicted moderate but meaningful growth on the heels of record high tourism receipts reaching more than $8 billion and originally forecasted to rise further. New oil and gas field exploration had been started and multimillion dollar international development projects had been launched including upgrades to rundown infrastructure.

Now foreign capital is fleeing. Qatari Diar recently announced it was terminating two of its real estate projects in Syria. Qatar Electricity and Water Company postponed building two major power plants estimated at $900 million. Emaar Properties halted another $500 million development project. The Institute of International Finance, a global bank group, predicts Syria's $52 billion economy is set to shrink by at least 3%.

Now for a recap of a series of Syrian ideological blunders that turned a bad situation worse. The Syrian government inaugurated a second wave of economic openness meant to replace working class loyalty, diminishing more and more, with widening the bourgeoisie base and enlarging its support. This strategy backfired in more ways than one. The move was really a continuation of the late Syrian president Hafez al-Assad who initiated this policy change with his 1991 law no. 10 with which he achieved a loosening of the legal frameworks governing foreign investments with 5-year customs and tax exemptions. President Bashar al-Assad’s own 5-year plan in 2005 went further into the direction of a ‘social free-market economy’, with a series of laws that ended state monopoly over the banking and the insurance systems respectively, facilitating measures for Foreign Direct Investments and leading to the creation of a stock market in February 2009.

Fault No.1: Liberalization of the economy meant the state had a diminished role in the economy, with fewer civil servants jobs and a decrease in state subsidies, which was a direct threat to the working classes and accelerated their alienation.

Fault No.2: The regime’s promise to develop Syria’s remote agricultural regions (such as Deraa, Deir Ez-Zor, Raqqa and Qamishly) was not fulfilled giving instead priority to attracting foreign investments, hoping to swing state income from oil revenues to direct taxation, with the vision being to see the emergence of a ‘useful Syria’ in vital areas like Damascus and its vicinity, Aleppo, and to a lesser extent the coastal region. The result of this misdeed towards the underprivileged was a breech in the ‘social contract’ which came with the assurance of welfare, jobs and cheap basic goods, in exchange for blind allegiance.

Deir Ez-Zor, Raqqa and Qamishly) was not fulfilled giving instead priority to attracting foreign investments, hoping to swing state income from oil revenues to direct taxation, with the vision being to see the emergence of a ‘useful Syria’ in vital areas like Damascus and its vicinity, Aleppo, and to a lesser extent the coastal region. The result of this misdeed towards the underprivileged was a breech in the ‘social contract’ which came with the assurance of welfare, jobs and cheap basic goods, in exchange for blind allegiance.

When the uprising started in Syria, the government tried a series of responses aiming at restoring some balance and dowsing the fire of anger before it spreads. It pledged to raise wages and create new jobs in the public sector. Assad then replaced Prime Minister Naji-al-Otri with Adel Safar, who was the minister of Agriculture and Agrarian Reforms – a direct message to agricultural workers that their difficulties were understood. The state recently increased Syria’s 2012 budget by 58% as a hint that the government is determined to restore elements of the welfare state. In January 2012 the Ministry of Housing is set to build 50,000 low cost housing units in all Syrian regions. But this apparently came too little too late with the unrest still in full swing.

Fault No.3: The economic reforms serving to create more business opportunities were designed to appeal to the upper class, but that did not happen. The Bourgeoisie, who had been in power for over 50 years, during which they supported the regime and helped it remain at the helm, resented the entry of new local and foreign players in the Syrian economy. For example the wealthy merchants and importers of rice, sugar, and other commodities, whose business the government would subsidize, reducing prices of wheat, rice, oil and fuel in half, now saw an Assad policy that said “anyone can import”. This created uproar because these merchants have ships, warehouses, international relations, especially with countries like China, and did not appreciate these “reforms”. Assad additionally requested German and French companies to arrange for oil exploration in the country, creating outcries from the “old guard” who had monopolized and profited from this activity for so many years. Now the upper class stopped their support, freezing economic activity. Syria had $18 billion in foreign cash reserves. In one year, it spent $6 billion. While the business community has remained for the large part a silent majority, without taking sides, some have joined the ranks of the opposition like the brothers Ali and Wassam Sanqar, sons of Omar Sanqar, a prominent figure of the Damascus business community and Ryad al-Seif, representative of Adidas in Syria, who has been appointed vice-president of the Syrian Transitional National Council, created August 29, 2011. As the social unrest grows, the undecided are likely to align themselves with one side or at least feel it necessary to transfer their assets abroad.

Now that we made the argument that Syria’s woes are socio-economic in nature, the Lebanese are invited to renew confidence in Lebanon and the real estate sector. The next argument is to address the options facing the Syrian bourgeoisie. The most pressing issue at hand outside of the unrest is the loss of confidence in the Syrian currency which might push Syrian entrepreneurs in the country to reallocate their assets abroad. According to Byblos Bank, deposits in Syrian accounts held by Lebanese banks dropped some 24% by the end of April 2011. As more Syrian businessmen sell their enterprises and exchange their capital into a foreign currency, the majority is likely to follow as they begin to realize that supporting demands for a new regime is more in their favor.

{C}{C}{C}{C}{C}{C}{C}{C}{C}{C} {C}{C}{C}{C}{C}

{C}{C}{C}{C}{C}

Meanwhile, Syrian real estate investors have little choices but to look for markets outside the Syrian borders. Currently, the housing market in Syria is suffering more than 50% decline in prices, with almost 30,000 vacant and another 20,000 unfinished housing units in Greater Damascus out of 250,000 units developed between 2002 & 2010. While low prices might seem like an opportunity for some to invest and buy, the unrest and unpredictability of events make this unlikely for any investor looking for assurances, and stability, and needing to know what type of government he is dealing with, what regulations will govern real estate and other important criteria currently unavailable.

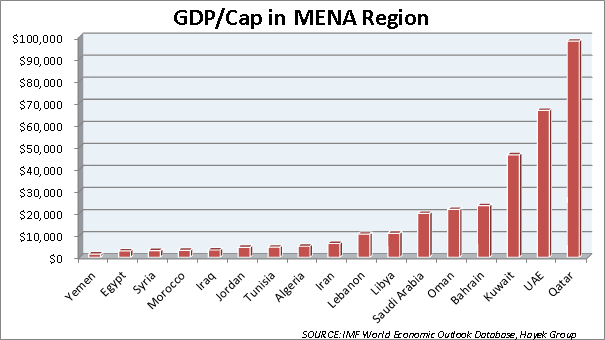

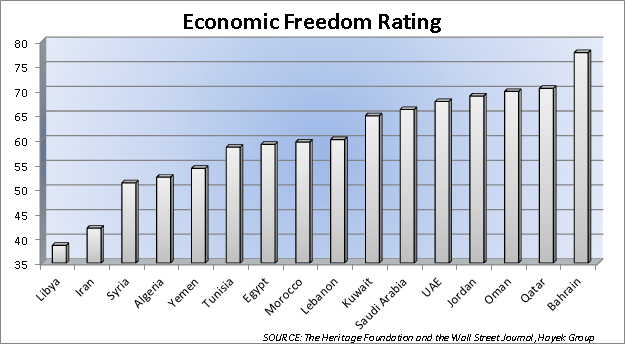

It is expected that short and midterm property investors will have a safe haven in the Lebanese markets, while Mega industries and trades in Syria might be more patient before deserting the Syrian market. Lebanon might be the best choice. The country enjoys stability for its economy and currency, no matter the crisis, be it local, regional or international. Lebanon ranks 8th among Arab countries with a GDP/Capita of $10,474, while Syria’s rank stands at 15 with $3,050. In economic freedom, Lebanon ranks 8th and Syria 14th (Refer to charts below). Lebanon’s real estate market has been going from strength to strength. The Syrian bourgeoisies can benefit from free market conditions and local know-how to make sensible profits on investments that can go beyond $1.8 billion in the foreseeable future. The areas of investment in property development such as hotels, hospitals, retail stores, commercial buildings, and middle income residential units in the Greater Beirut areas stretching from Bchamoon, Hazmieh, Yarze and leading to Jounieh, can provide the Lebanese property market a renewed momentum. Since these Syrian investors are using their own capital without having to resort to bank loans and pay interest, the properties they will be building have a better chance at being sold if their strategic pricing returns affordable margins, i.e always competitive with Lebanese builders who don’t enjoy the same financing conditions.

{C}{C}{C}{C}{C}{C}{C}{C}{C}{C} {C}{C}{C}{C}{C}

{C}{C}{C}{C}{C}

The bullish optimism of Syria’s upper classes was symbolized in the huge double tower block project underway in downtown Damascus: a high-tech steel and glass masterpiece for one of the world’s most ancient cities. A vast excavation was dug out for the foundations, surrounded by billboards showing President Bashar al-Assad’s face alongside the slogan “Together we build”. But work has stopped, leaving an enormous empty hole in the ground. “Together we build” will be seen on many projects and prime properties in the Greater Beirut area, funded by Syrian investors and sold at affordable margins. Lebanese! Don’t be afraid. Syria’s troubles are an economic issue. Should the borders close, Lebanon stands to lose exports worth $230 million per year to Syria, or the price of one downtown building. The impact is minimal. Syrians! It’s too risky to sit on your money. Use it in the country that offers you the best investment environment in the Middle East.

Coming Soon

Want to become a big league investor? Grand opportunities await you.

Abdallah Hayek P.E

CEO

Hayek Group s.a.r.l

Beirut - Feb. 2012

Back To Newsletters