Real Estate Economics in Lebanon - Jan. 2018

- Wednesday, October 16, 2019

low dose naltrexone buy

where to buy naltrexone

It is not easy to make any decision in the field of real estate investment in Lebanon until after conducting an in-depth study of the situation of the market and the direct and indirect effects on the risks and rates of acceptable success.

.jpg) During the past 12 years, the real estate market in Lebanon has been characterized by a resilience that is difficult to explain scientifically, due to the difficult political, security and economic conditions it has experienced since 2005.

During the past 12 years, the real estate market in Lebanon has been characterized by a resilience that is difficult to explain scientifically, due to the difficult political, security and economic conditions it has experienced since 2005.

While land prices in Beirut and Mount Lebanon maintained an acceptable pace of rise, we believe that these ratios remained stable in 2017 with a slight decrease in prices due to the supply and demand movement and the low purchasing power of the consumer.

Figures from the Ministry of Finance's Directorate General of Land Registry and Cadastre up to November show some results from the construction movement in 2017, with monthly sales exceeding 8,000 in October 2017 and recording 8,283 operations for the first time in five years, December 2012. (Fig. 1)

.jpg)

As for the total property monthly fees, it exceeded the threshold of 100 billion LBP during March, August and October 2017. This rate has not been recorded for three months in one year since 2005. It should be noted that the fees in March 2017 recorded 114.9 billion LBP, which is the second largest number after fees recorded in December 2012 amounted to 118.0 billion LBP. (Fig. 2)

.jpg)

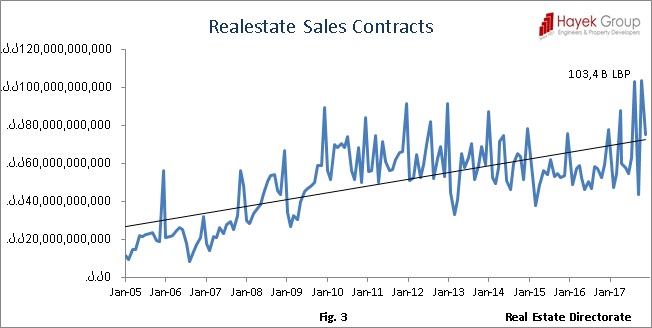

As for value of the real estate sales contracts, the monthly average exceeded 100 billion LBP in August and October, reaching 103.4 billion LBP, a record amount for the first time since January 2005. (Fig. 3)

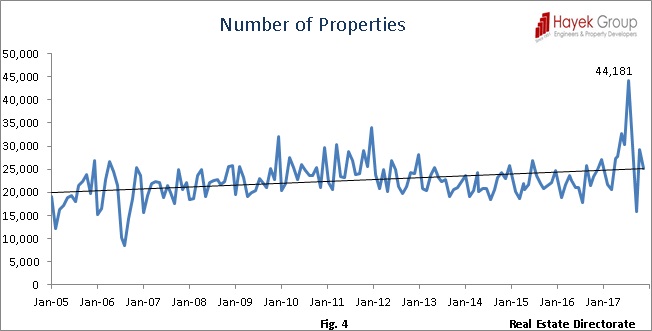

The total number of properties registered 44,181 properties in July, a record not seen by real estate departments for the past 17 years. (Fig. 4)

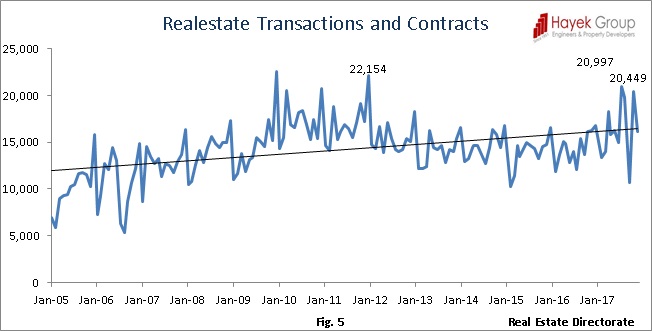

The total number of transactions and real estate contracts exceeded the threshold of 20,000 transactions, with 20,997 in July and 20,449 in October 2017 for the first time in 6 years, specifically since December 2011. (Fig. 5)

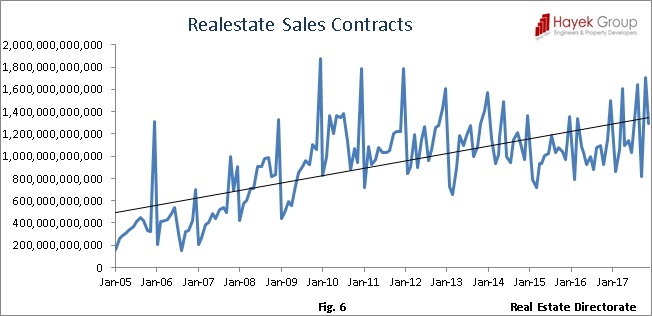

The value of real estate sales contracts reached US $ 823.5 million, as a monthly average in 2017, up 17 percent from the 2016 monthly average of US $684,2 million, noting that the value reached US $ 678,6 million as an average monthly value from 2007 to 2016, a total increase of 18% over ten years. (Fig. 6)

It is clear from the above that the fundamentals of persistence in the real estate sector in Lebanon exceeded all expectations in 2017 and this leads us to look at 2018 with optimism based on several additional facts:

1 - Oil & Gas extraction:

In 2017, the Council of Ministers approved resolutions 42 and 43 for the exploration of oil and gas. Lebanese territorial waters were distributed into 10 blocks. On 14 December, the Council approved the licensing of a consortium between French company Total, Anni of Italy and Novatech of Russia for oil and gas exploration in Block 4 and 9 in the north and the south. According to figures released by the Ministry of Energy, the share of Lebanon is between US $ 27 billion and US $ 36 billion per year.

In 2017, the Council of Ministers approved resolutions 42 and 43 for the exploration of oil and gas. Lebanese territorial waters were distributed into 10 blocks. On 14 December, the Council approved the licensing of a consortium between French company Total, Anni of Italy and Novatech of Russia for oil and gas exploration in Block 4 and 9 in the north and the south. According to figures released by the Ministry of Energy, the share of Lebanon is between US $ 27 billion and US $ 36 billion per year.

According to the US Bureau of Labor, every investment in infrastructure projects worth US $ 1 billion in developing countries provides 8,000 jobs of which 5,000 will be on-site and 3,000 will be outsourced into transportation, logistics and technical services that will benefit from these projects. If US $ 10 billion is invested annually in infrastructure projects, 80,000 jobs will be secured annually , Which will lead to an urban revival and will also lead to the recovery of the construction sector and will have a response Which will encourage the increase of confidence in foreign investment in several sectors, especially the services and logistics sectors. The labor required for this process requires the securing of housing units close to the working sites, where thousands of workers and specialists will be absorbed, which will raise the rate of rents and hence property prices in nearby areas which will inevitably lead to the development of neighboring rural areas.

2. Situation in Syria:

.jpg)

With the cessation of fighting in Syria, and the expectation of reconstruction, albeit of non-availability of project financing by international donors and lenders, which is expected to exceed 250 billion US dollars, Lebanon is highly qualified to host a logistic operation for construction materials and the use of technical expertise of Lebanese companies that have been able to implement construction and infrastructure contracts especially in the Gulf countries, in addition to the effective operations of Lebanese banks in the Syrian banking system even during the worse fighting conditions. All this will help the real estate sector and the economy in general by securing employment opportunities, which will increase growth and purchasing power of the local consumer.

3 - Political stability:

Lebanon has not witnessed stability "on the political scene for many years, but the era of President Michel Aoun and the government of Prime Minister Hariri have achieved many indicators that will help stabilize the real estate sector, the parliamentary elections expected in May 2018 will inevitably lead to a new dynamic through the emergence of a new political coalitions, as well as the adoption of the state budget, as well as the stability of the security situation and limit political differences within institutions without protesting and street riots, in addition to the safety of the monetary situation and the ability of banks and the private sector to finance projects through internal borrowing. All this will give positive signs of investment in the real estate sector.

It is the responsibility of the administration to sponsor this sector by providing appropriate legislative cover, reviewing unfair tax laws against owners and tenants, and adopting a 25-year plan for infrastructure projects in the country, especially coastal areas, by improving transportation networks including roads, harbors and airports and securing adequate public utilities of electricity, water and sanitation, as well as the establishment of a higher building commission that sponsors the construction sector and ensures its safety.

It is the responsibility of the administration to sponsor this sector by providing appropriate legislative cover, reviewing unfair tax laws against owners and tenants, and adopting a 25-year plan for infrastructure projects in the country, especially coastal areas, by improving transportation networks including roads, harbors and airports and securing adequate public utilities of electricity, water and sanitation, as well as the establishment of a higher building commission that sponsors the construction sector and ensures its safety.

We assure all that despite all the critical stages in which Lebanon has been through military and political assassinations and conflicts and the absence of a proper public utilities for more than 35 years, the real estate sector has witnessed no collapse, and this is the principal evidence of the safety of investment in real estate in the medium and long term.

Abdallah Hayek PE

Hayek Group LLC

Beirut, Jan 2018

Back To Newsletters